Insight Hub

Your go-to source for the latest in news and information.

Whole Life Insurance: The Secret to Lifelong Financial Security

Unlock lifelong financial security! Discover how whole life insurance can be your secret weapon for a worry-free future.

Understanding Whole Life Insurance: How It Ensures Lifelong Financial Security

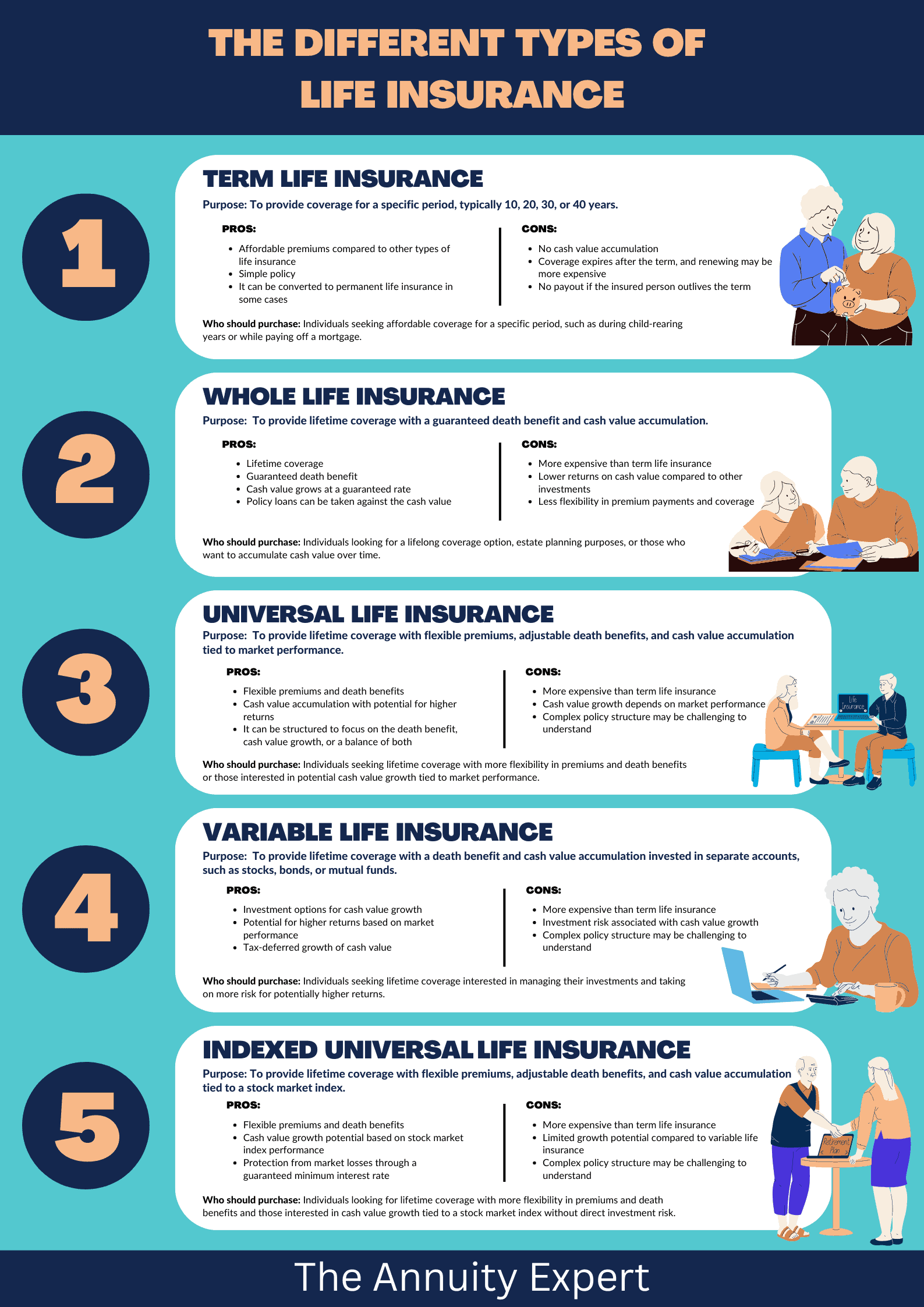

Whole life insurance is a type of permanent life insurance that not only provides a death benefit to your beneficiaries but also accumulates cash value over time. This means that your policy can serve as a long-term investment, ensuring financial security for you and your loved ones. As you pay your premiums, a portion goes into a savings component, which grows at a guaranteed rate. To learn more about how whole life insurance works, check out this detailed guide from Investopedia.

Understanding whole life insurance is essential for anyone looking to achieve lifelong financial stability. One of the key benefits is its predictability; premium payments remain level throughout the life of the policy. Furthermore, the policyholder can borrow against the accumulated cash value, providing a source of funds in times of need. For an in-depth look at policy loans and other financial strategies, visit NerdWallet.

5 Key Benefits of Whole Life Insurance You Need to Know

Whole life insurance offers numerous benefits that can significantly impact your financial security. Here are the top 5 key benefits you need to know:

- Lifetime Coverage: Whole life insurance provides coverage for your entire life, as long as the premiums are paid. This guarantees that your beneficiaries will receive a death benefit regardless of when you pass away.

- Cash Value Accumulation: Unlike term life insurance, a portion of your premium goes into a cash value account that grows over time. This cash value can be borrowed against or even withdrawn in times of need, providing a financial cushion during emergencies. For more on cash value growth, visit Investopedia.

- Premium Stability: Whole life insurance premiums remain level throughout the life of the policy, offering peace of mind that the cost won't increase as you age. This financial predictability is a strong advantage, particularly as other expenses may fluctuate over time.

- Dividends Potential: Many whole life insurance policies are eligible for dividends, which can be used to pay premiums, purchase additional coverage, or be cashed out. These dividends, declared by the insurance company, add a layer of value to your policy.

- Tax Advantages: The growth of the cash value is tax-deferred, and the death benefit is generally paid out tax-free to your beneficiaries. This makes whole life insurance an effective tool for estate planning. Learn more about the tax benefits by reading on Forbes.

Is Whole Life Insurance Right for You? Common Questions Answered

Whole life insurance can be a valuable financial tool, but it isn't suitable for everyone. If you're considering whether whole life insurance is right for you, here are some common questions to consider:

- What are my long-term financial goals?

- Do I prefer a more predictable savings vehicle?

- How does whole life insurance fit into my overall financial plan?

One important aspect of whole life insurance is its cash value feature, which accumulates over time. This can serve as a savings component that you can borrow against if needed. However, it’s crucial to understand the costs involved. Whole life insurance typically comes with higher premiums compared to term policies. For more detailed insights on whether whole life insurance suits your needs, consider checking resources like NerdWallet and Forbes.