Insight Hub

Your go-to source for the latest in news and information.

Insurance Showdown: Finding Your Best Coverage Match

Discover the ultimate guide to insurance! Uncover tips and tricks to find your perfect coverage match in our Insurance Showdown blog!

Understanding the Different Types of Insurance: Which One is Right for You?

Understanding insurance is essential for safeguarding your financial future. With various types of insurance available, it's crucial to identify which one is right for you. Insurance generally falls into several categories: health, life, auto, home, and liability insurance. Each type serves a distinct purpose: health insurance covers medical expenses, life insurance provides financial security for your dependents in the event of your death, auto insurance protects you from vehicle-related risks, home insurance safeguards your property, and liability insurance protects against claims resulting from injuries or damages.

When considering which insurance is right for you, assess your individual needs and circumstances. For instance, if you have dependents, life insurance is vital to ensure their financial well-being. If you own a home, investing in homeowners insurance can offer peace of mind against natural disasters or theft. It's also wise to consider health insurance, especially if you have ongoing medical needs. Furthermore, evaluating liability insurance can be crucial for professionals and business owners to protect against potential lawsuits. Ultimately, selecting the appropriate types of insurance depends on your personal situation and risk tolerance.

Top 5 Tips for Comparing Insurance Policies: Get the Best Coverage

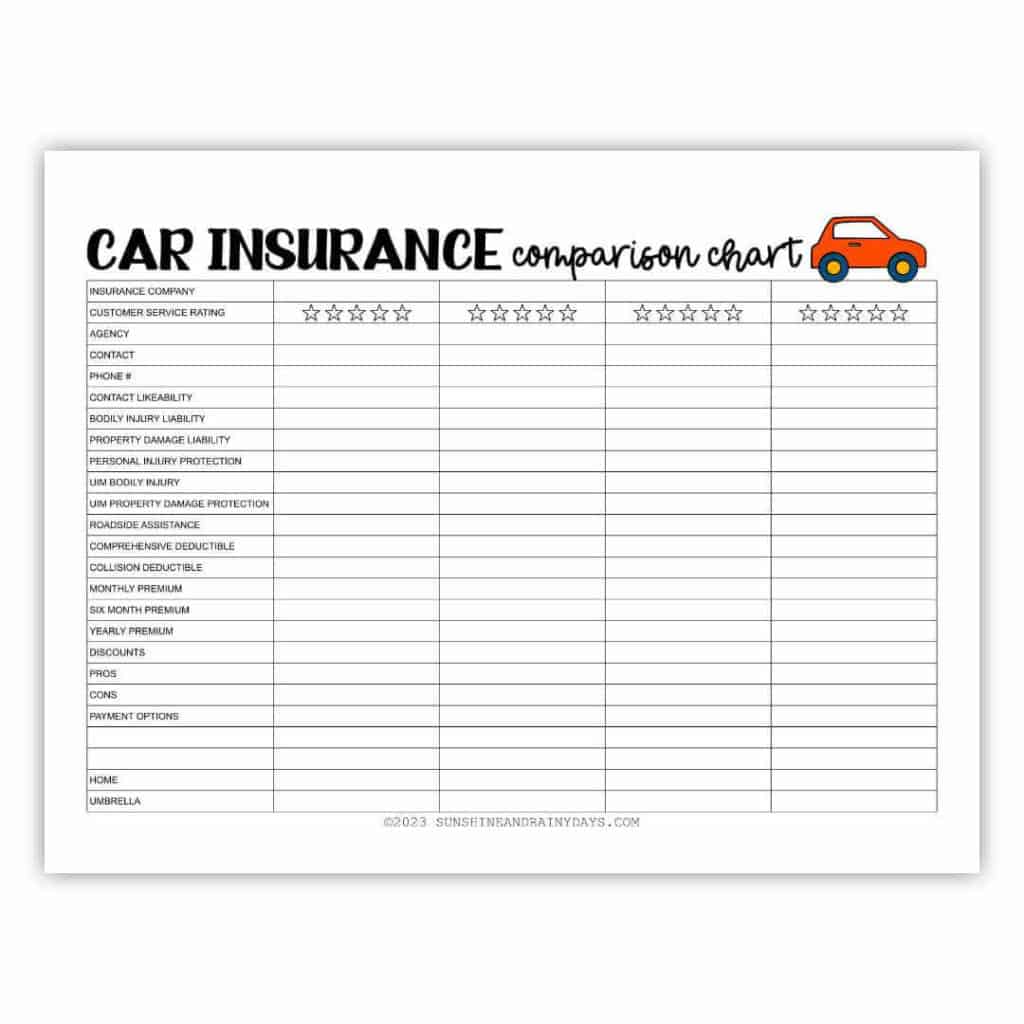

When it comes to comparing insurance policies, understanding your needs is the first step. Before diving into the details of various plans, take the time to evaluate your personal situation, including your budget, coverage requirements, and risk tolerance. Create a list of non-negotiable aspects of your desired policy, such as premiums, deductibles, and specific coverages you cannot compromise on. This initial assessment will guide you through the comparison process effectively.

Next, make use of comparison tools or insurance brokers to facilitate your search. These resources can provide you with real-time quotes and side-by-side comparisons of policies from multiple providers. Once you have gathered all necessary information, prioritize factors that matter most to you. Make sure to review the policy exclusions and limitations as well, as these can significantly impact your coverage. You’ll want to ensure that you are not just looking at the price, but also the value and protection each policy offers.

Common Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, misconceptions abound. One common myth is that insurance policies are too expensive for the average person. In reality, there are various options available to fit different budgets. Many insurers offer flexible payment plans and discounts for bundling multiple policies, making it easier for individuals and families to protect themselves. Understanding your needs can help you find coverage that won’t break the bank.

Another prevalent myth is that insurance coverage is unnecessary if you are healthy or young. Many believe they won’t need insurance until they are older or have serious health issues. This myth can be dangerous, as unexpected accidents or illnesses can occur at any age. Having a robust insurance plan provides peace of mind and financial protection to ensure you’re not left in a precarious situation. Always consider the long-term benefits of being insured, regardless of your current health status.