Insight Hub

Your go-to source for the latest in news and information.

Lost in the Crypto Jungle of Shitcoins

Dive into the wild world of shitcoins! Discover hidden gems, avoid traps, and navigate the crypto jungle like a pro.

Understanding the Risks: Navigating the World of Shitcoins

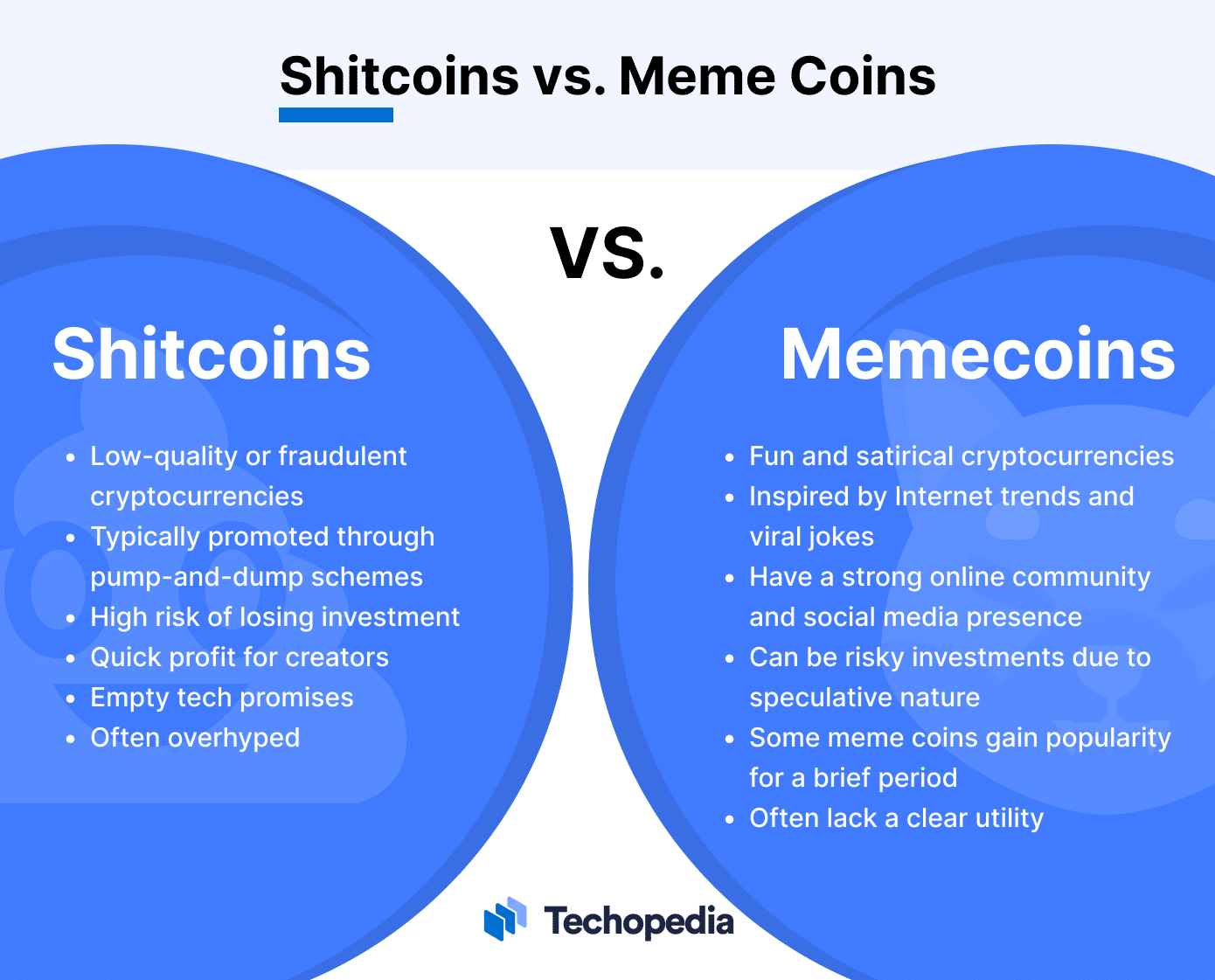

Investing in shitcoins can be an enticing yet perilous venture for both novice and experienced traders. These cryptocurrencies, often lacking a solid foundation or utility, can promise quick returns but come with daunting risks. According to a report from Investing.com, many shitcoins are created in the hopes of capitalizing on the hype surrounding popular coins, only to fade into obscurity. Understanding the volatile nature of these assets is crucial, as many are designed with malicious intent, aiming to defraud unsuspecting investors.

The first step in navigating the world of shitcoins is to conduct thorough research. Tools such as CoinMarketCap and CoinGecko can be invaluable in evaluating a coin's market data and community engagement. Additionally, be wary of pump and dump schemes, where the value of a coin is artificially inflated before the creators sell off their shares, leaving other investors at a loss. Always remember to invest only what you can afford to lose, and consider diversifying your portfolio to mitigate potential risks.

Top 10 Shitcoins: Are They Worth Your Investment?

The world of cryptocurrency is rife with opportunities and pitfalls, and among the myriad of tokens available, shitcoins often catch the eye of investors seeking quick gains. Defined generally as cryptocurrencies without a solid project behind them or a clear purpose, shitcoins can range from memecoins like Dogecoin to totally obscure tokens that promise the moon but deliver little. As you dive into the top 10 shitcoins, it’s crucial to assess whether they are worth your investment. A comprehensive research and a clear understanding of the risks associated with these tokens will help in making informed decisions.

Before investing, take a moment to examine each coin's fundamentals, community engagement, and developer activity. For instance, projects like EverGrow Coin have garnered attention for their unique selling propositions, while others may simply rely on hype. Remember to consider not just the potential for profits but also the possibility of loss. Ultimately, identifying value among the top 10 shitcoins requires due diligence and a cautious approach to avoid falling victim to market volatility. For more insights, check out Investing.com's Guide to Altcoins.

How to Spot a Shitcoin: Red Flags Every Investor Should Know

Investing in cryptocurrencies can be a lucrative adventure, but it’s crucial to be able to identify potential pitfalls. One of the most significant risks is falling victim to a shitcoin, a term used to describe cryptocurrencies with little to no value or utility. Here are some red flags every investor should watch out for:

- Unclear Purpose: If the coin's website and whitepaper lack clear use cases or benefits, it's a warning sign. Projects should clearly outline their goals and how they intend to achieve them.

- High Developer Promises: Beware of projects that promise unrealistic returns. If a coin claims to make you rich overnight, it's likely too good to be true.

- Poor Community Engagement: Genuine projects typically foster active communities. Check social media platforms or forums to see how engaged the community is.

Another major concern is the lack of transparency. Authentic teams usually disclose their identities and qualifications, whereas shitcoin creators often remain anonymous or use pseudonyms. Here are additional red flags to consider:

- No Working Product: If there is no demo or live application showcasing the technology, be cautious.

- Unsustainable Marketing Techniques: Over-the-top marketing campaigns can indicate desperation. If you see massive amounts of advertisements promising quick gains, it's a cause for concern.

- Pumping and Dumping: If the coin shows increasing price volatility with sharp rises and falls, it may be the result of coordinated pump and dump schemes.