Insight Hub

Your go-to source for the latest in news and information.

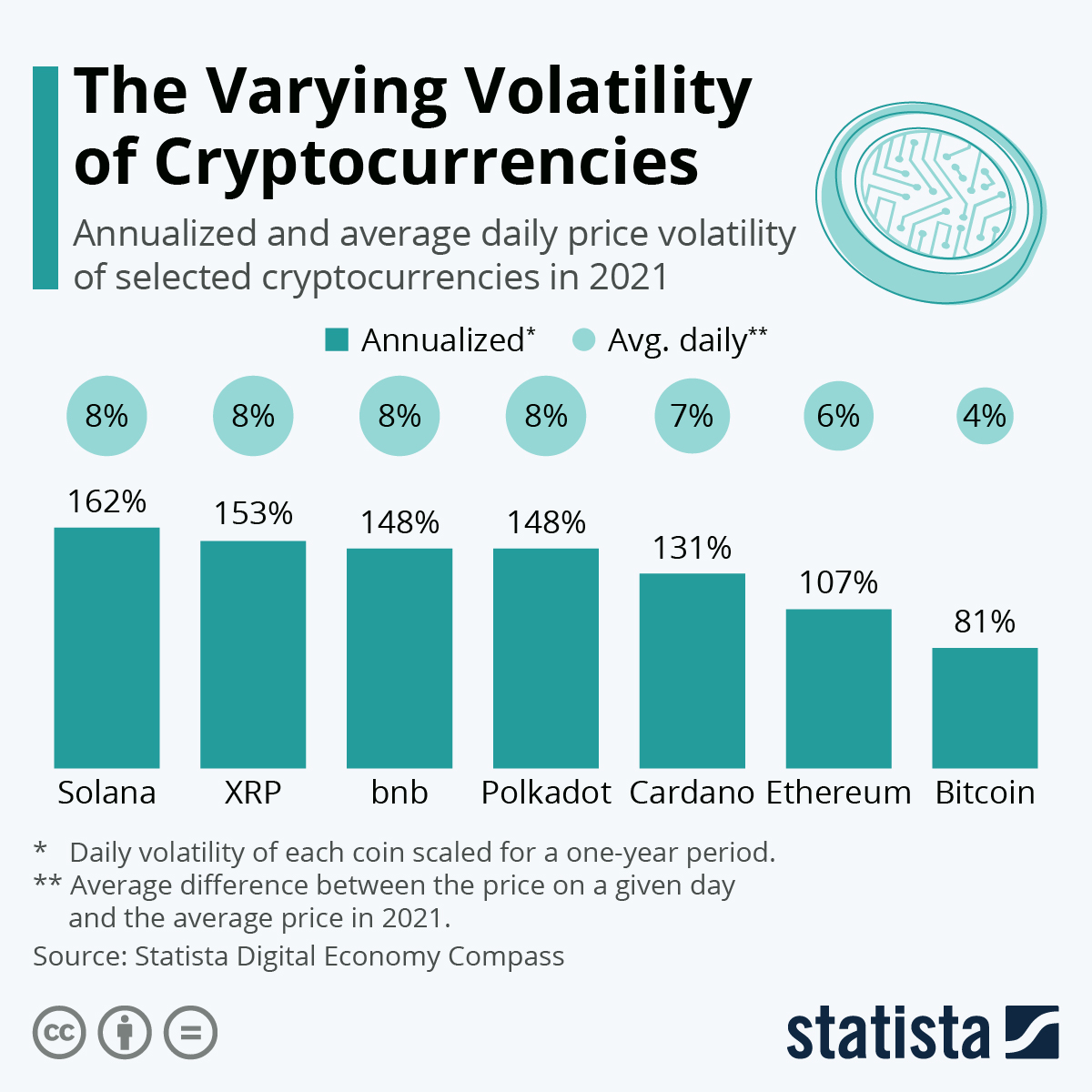

Crypto Whirlwinds: How Market Volatility Shapes Your Digital Fortune

Discover how crypto market volatility can make or break your digital fortune. Learn to navigate the whirlwind and thrive in the chaos!

Understanding the Storm: What Causes Crypto Market Volatility?

Understanding the volatility of the crypto market requires a deep dive into various external and internal factors that influence price swings. One major contributor is market sentiment, which can be affected by news events, regulatory developments, and public opinion. For instance, announcements about potential regulations or bans on cryptocurrency usage can lead to rapid sell-offs, while positive news can drive substantial buying. Additionally, the relative newness of the crypto sector makes it particularly susceptible to rumors and speculation, which can exacerbate price fluctuations.

Another factor that contributes significantly to crypto market volatility is the inherent nature of the assets themselves. Many cryptocurrencies have relatively low liquidity compared to traditional financial markets. This means that large investments can disproportionately influence price movements. Additionally, the presence of whales—individuals or entities that hold significant amounts of cryptocurrency—can lead to sudden market drops if they decide to sell off their holdings. Furthermore, technological developments, such as upgrades to blockchain networks or vulnerabilities discovered in smart contracts, can also lead to sudden shifts in confidence and price.

Counter-Strike is a popular first-person shooter game that pits teams against each other in various objective-based scenarios. Players can choose between different roles, such as terrorists or counter-terrorists, while utilizing a range of weapons and tactics to achieve victory. For those looking to enhance their gaming experience, you can check out the cloudbet promo code for exciting bonuses.

10 Tips for Navigating Market Whirlwinds and Protecting Your Digital Assets

In today's fast-paced digital landscape, navigating market whirlwinds requires a proactive strategy to safeguard your assets. Here are 10 tips to help you protect your digital investments:

- Diversify Your Portfolio: Spread your assets across different platforms to minimize risk.

- Stay Informed: Regularly monitor market trends and updates to make informed decisions.

- Utilize Security Tools: Employ robust cybersecurity measures to protect your digital assets.

Additionally, consider these effective strategies:

- Set Clear Goals: Define your investment objectives to guide your actions.

- Limit Emotional Trading: Avoid impulsive decisions driven by market fluctuations.

- Engage in Continuous Education: Invest time in learning about market dynamics and asset management.

- Network with Professionals: Connect with industry experts to gain valuable insights.

- Review Performance Regularly: Assess your portfolio’s performance and make adjustments as necessary.

- Plan for the Unexpected: Always have a contingency plan in place.

Is Market Volatility a Friend or Foe? Exploring the Pros and Cons for Investors

Market volatility can be viewed through a dual lens, presenting both opportunities and challenges for investors. On one hand, volatility often leads to price fluctuations that savvy investors can capitalize on, enabling them to buy low and sell high. This dynamic environment can foster lucrative investment strategies, such as options trading or short selling, which thrive on significant price changes. Additionally, market downturns often lead to overreactions, presenting valuable buying opportunities for long-term investors who are willing to weather the storm.

Conversely, market volatility can act as a formidable foe, particularly for those who lack experience or are risk-averse. The unpredictability inherent in volatile markets can lead to hasty decisions and panic selling, resulting in substantial financial losses. Furthermore, frequent fluctuations can disrupt investment strategies that depend on stability, thus increasing overall portfolio risk. In essence, while market volatility can provide compelling opportunities, it also necessitates a thorough understanding and a well-thought-out approach to mitigate potential downsides.